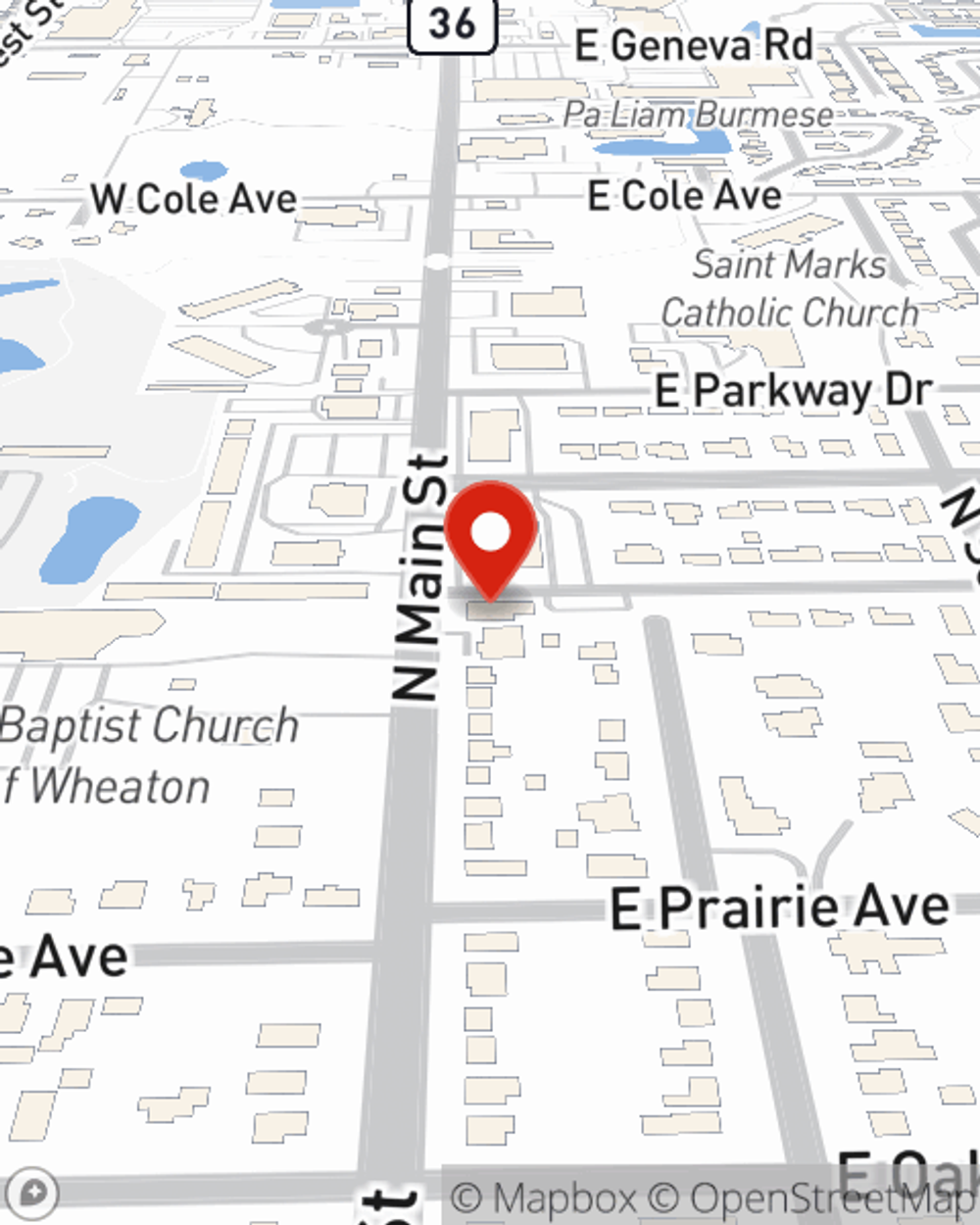

Business Insurance in and around Wheaton

Searching for coverage for your business? Look no further than State Farm agent Jon Mock!

Insure your business, intentionally

- Wheaton

- Glen Ellyn

- Carol Stream

- Winfield

- Warrenville

- Naperville

- West Chicago

- Chicago

- Aurora

- St. Charles

- Glendale Heights

- DuPage County

- Batavia

- Woodridge

- Lisle

- Joliet

- Plainfield

- Oswego

- Montgomery

Insure The Business You've Built.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes problems like a customer hurting themselves can happen on your business's property.

Searching for coverage for your business? Look no further than State Farm agent Jon Mock!

Insure your business, intentionally

Customizable Coverage For Your Business

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Jon Mock can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Don’t let fears about your business stress you out! Visit State Farm agent Jon Mock today, and see the advantages of State Farm small business insurance.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Jon Mock

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.